Getting maid insurance? Here’s your guide to MOM’s latest requirements

4-minute read | Last updated: August 2023

If you’re planning to hire a new domestic worker or renew the contract of your current helper, it pays to familiarise yourself with the Ministry of Manpower’s latest regulations for medical insurance coverage. In case you’ve missed it, we’ve summarised the benefits here for you!

These new rules, which take effect from 1 July 2023, help alleviate the financial burdens of employers, in light of rising medical costs. In fact, MOM highlighted that more than 1,000 employers a year struggle with medical bills exceeding the $15,000 coverage limit.

Apart from safeguarding employers, the enhanced regulations provide greater protection for the health and well-being of domestic workers who contribute invaluably to households across Singapore.

MOM's 5 key changes to take note of:

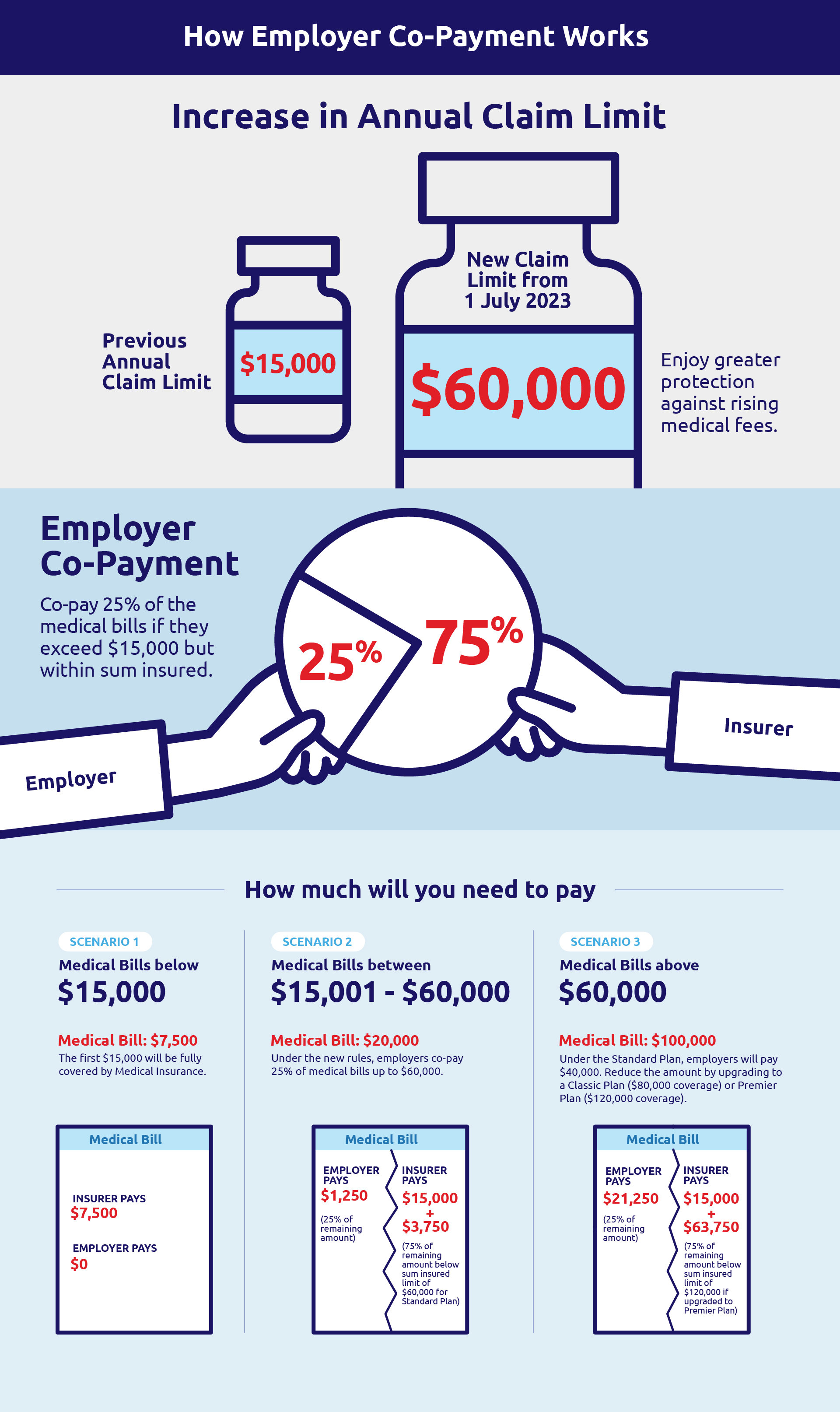

1. Increase in Annual Claim Limit to $60,000

Up from $15,000 previously, the new medical insurance will offer an annual claim limit of at least $60,000 to help defray bigger bills and minimise out-of-pocket expenses. You can upgrade the $60,000 cover (Standard Plan) to $80,000 (Classic Plan) or $120,000 (Premier Plan) for greater coverage. Your helper will also enjoy up to 90 days pre- and post-hospitalisation expenses for diagnostic services and treatment under all plans.

2. 25% Employer Co-Payment

We fully insure the first $15,000. A 25% co-payment will be required for bills from $15,001 to $60,000 (Standard Plan). You will be required to make full payment for amounts that exceed your claim limit.

3. Option to Reduce Co-Payment

If you would like to lower the 25% co-payment, we offer the flexibility to bring it down to 10% or even 0%. This further reduces expenses borne by employers during medical emergencies.

4. Direct Reimbursement to Hospitals

You will no longer have to pre-pay the entire hospital bill and make a claim later. MSIG will reimburse our portion of the bill directly to the hospital upon admissibility of the medical claim.

5. Age-differentiated Premiums

There are now different premiums for those aged 50 and below; and above 50. Age differentiation keeps premiums affordable as the majority of helpers tend to be younger.

How we have enhanced our MaidPlus plan:

These improvements are a significant upgrade over what we had previously. The good news is MSIG’s MaidPlus goes above and beyond MOM’s requirements to provide greater insurance coverage and peace of mind. Here are additional benefits you’ll enjoy with MSIG MaidPlus:

1. Coverage for Traditional Chinese Medicine or Alternative Treatments

We cover up to $3,000 for medical expenses due to injury, which includes sub-limits for dengue fever, dental and TCM treatment.

2. Compassionate Travel Expenses

We cover up to $500 for your helper’s travel expenses if she has to travel home due to the passing of a legal parent, spouse or child.

3. Reimbursement of Compassionate Home Leave

If your helper has to take compassionate home leave, you will receive compensation of up to $420 for wages and levies.

4. Hiring Expenses for a Replacement Maid

In the event you have to terminate your domestic worker’s service due to injury, illness or death, we pay up to $750 to engage a replacement maid.

Still have questions? Read the FAQ below:

Q: My MaidPlus policy started before 1 July 2023. How will the new enhancements affect my policy? Can I upgrade it?

A: Your current MaidPlus policy will not be affected. You do not need to upgrade your policy. MOM’s new regulations apply only to policies that start from 1 July 2023.

Q: Will my helper’s pre-existing medical condition be covered under the new rules?

A: Hospital and surgical expenses for any pre-existing conditions are covered after the first 12 months of employment with the same employer. Under the new rules, the sum insured will be up to $60,000 with employers co-paying 25% for the portion of eligible claims exceeding the first $15,000.

Q: How can I reduce my 25% co-payment for hospital bills exceeding $15,000?

A: Choose to reduce co-payment to 10% or even 0% by selecting ‘Reduction of co-payment’ at the point of purchase. This option cannot be amended once your plan has started.

Q: Will my helper be covered during an overseas holiday?

A: MaidPlus covers hospitalisation expenses incurred on an overseas trip, provided your helper is travelling with you. However, a separate travel insurance will provide comprehensive cover for any eventualities.

Q: Will my helper be covered on home leave?

A: When on home leave, your helper will only be covered for accidental death and permanent disablement. All other benefits will cease till she returns to Singapore.

Get MSIG MaidPlus insurance

Your helper is an essential member of your family. To protect her well-being and your interest, we designed MSIG MaidPlus to incorporate MOM’s new requirements – and more! Click here to learn more about MSIG MaidPlus and the comprehensive cover we provide.

From time to time, we have exclusive promotions on our insurance plans. View our latest deals here!

Policy terms and conditions apply.