Highlights

MSIG Singapore recognised for strong digital performance, product innovation and service excellence driven by technology adoption

MSIG Singapore has been named Digital Insurer of the Year at The Asset Triple A Digital Finance Awards 2026.

IP rider changes: what every individual needs to know to stay protected

Learn how new IP rider limits could raise your hospital bill and reassess your protection before it’s too late!

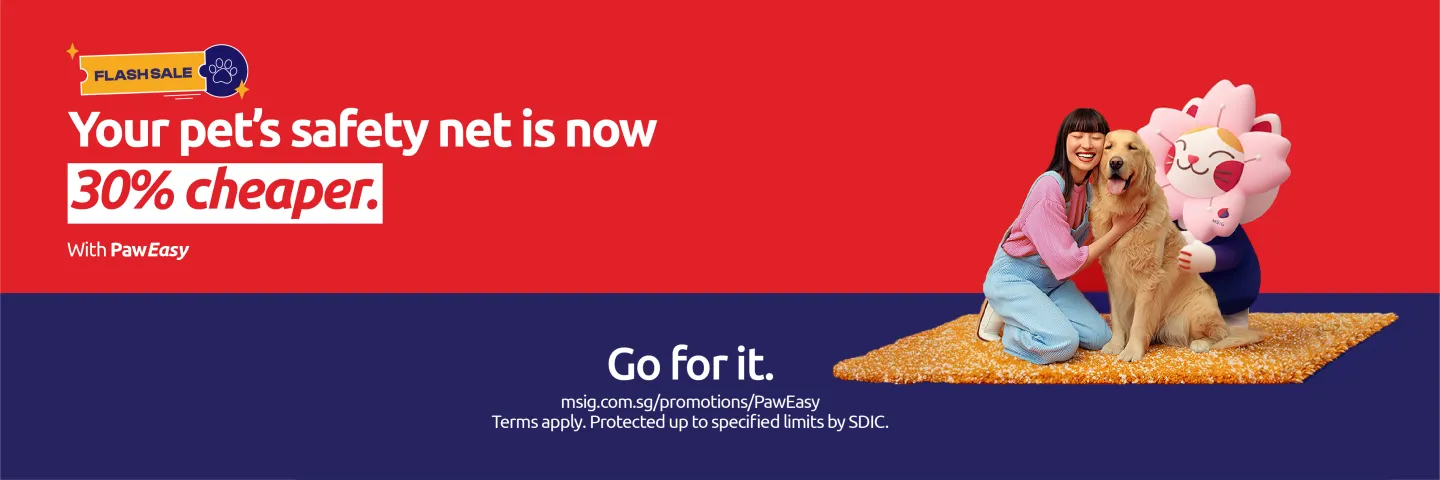

Monee and MSIG partner to launch pet insurance on Shopee with free one-month complimentary coverage

Redeem free one-month pet insurance on Shopee and upgrade for more coverage from just $0.20 per day!

What lies ahead for Marine Insurance in 2026?

Geopolitical tensions, shifting trade policies and market volatility are redefining risk and reshaping underwriting strategies. Find out what’s on the horizon for the marine industry.

MSIG Singapore Achieves Eco Office 4-Leaf Certification

This is the highest recognition under the Eco-Office Programme.

Digitalisation, tariffs and autonomous vehicles shape non-life industry

Singapore’s non-life insurance industry is being transformed by digitalisation, US tariffs, and the rise of autonomous vehicles. More insights in an interview special by Asia Insurance Review with Mack Eng, CEO of MSIG Singapore.

The CFO’s paradox: Playing it safe is now the riskiest move

In her op-ed for The Edge Singapore, our CFO shares how the role of finance leaders has transformed – from stewards of balance sheets to architects of value creation.

MSIG Singapore honoured for Leadership in Personal Lines and Underwriting Excellence

MSIG Singapore emerged as a double winner at the inaugural Asia Consumer Insurance Awards 2025.