Mitsui Sumitomo Insurance issues catastrophe bond “Akibare Re 2020-1” in Singapore

07 Apr 2020

Mitsui Sumitomo Insurance Co., Ltd. (President: Noriyuki Hara, “MSI”), a subsidiary of MS&AD Insurance Group Holdings Inc., has sponsored catastrophe bond (“cat bond”) Akibare Re Pte. Ltd. Series 2020-1 (“Akibare Re 2020-1”) , which will provide MSI with protection against qualifying typhoon risk and flood risk in Japan.

This landmark transaction is MSI’s fifth cat bond issuance since its first issuance in 2007 and represents the first ever Asian sponsored cat bond issued out of Singapore. Singapore is aiming to become an ILS Domicile for Asia by promoting effective use of insurance-linked securities (*) such as cat bonds in the region, and by enhancing the sustainability of the ILS ecosystem and subsidies.

MS&AD Insurance Group strives to continuously make effective use of reinsurance and cat bonds, thereby further strengthening its risk management and enhancing financial soundness.

(*) A generic term for securitized products that cover insurance risk. It is used as a risk transfer method that utilizes the capital markets. Investing in securitized products enables investors to obtain investment yields that have low correlation with general financial markets.

1. Summary of Akibare Re 2020-1

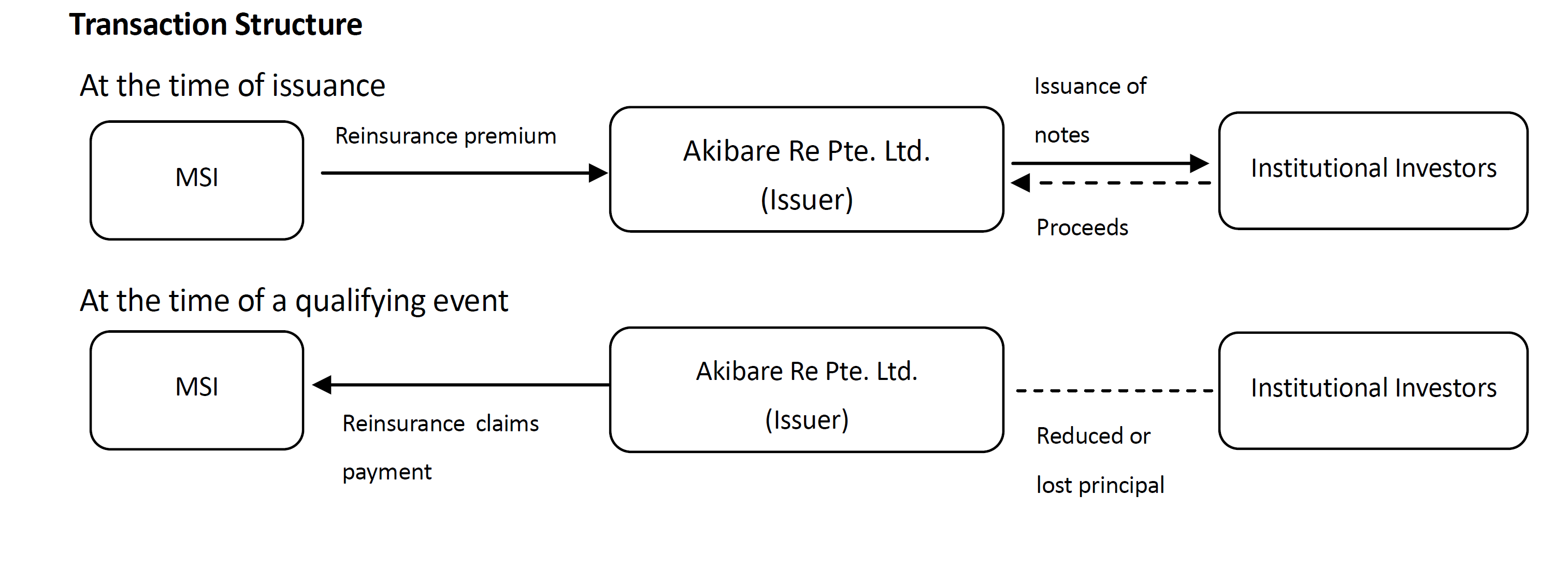

Akibare Re 2020-1 is a cat bond sponsored by MSI and issued to institutional investors via Akibare Re Pte. Ltd., a Singapore-domiciled special purpose reinsurance vehicle. The cat bond is structured so that all or part of the principal otherwise due for return to investors at maturity would be transferred to the sponsors, if the incurred loss amount from qualifying typhoon and flood events in Japan exceeds a pre-defined threshold.

| Issue Date | March 2020 |

| Scheduled Redemption Date |

April 2024 (4-year risk period) |

| Covered Event | Typhoon and Flood event in Japan |

| Size |

USD 100 million |

| Risk Spread | MMF+2.75% per annum |

(*) JPY value converted at the rate of 1 USD = JPY 110

2. Background of Akibare Re 2020-1

In recent years, Japan has experienced an increasing number of large losses resulting from natural catastrophes, such as typhoon and flood events. In preparation for these, MSI has utilized reinsurance in order to reduce its net retained risk amount. Furthermore, given the growing interest amongst institutional investors towards cat bonds covering natural catastrophe risks in Japan, MSI sponsored the cat bond and successfully further diversified its sources of capacity.